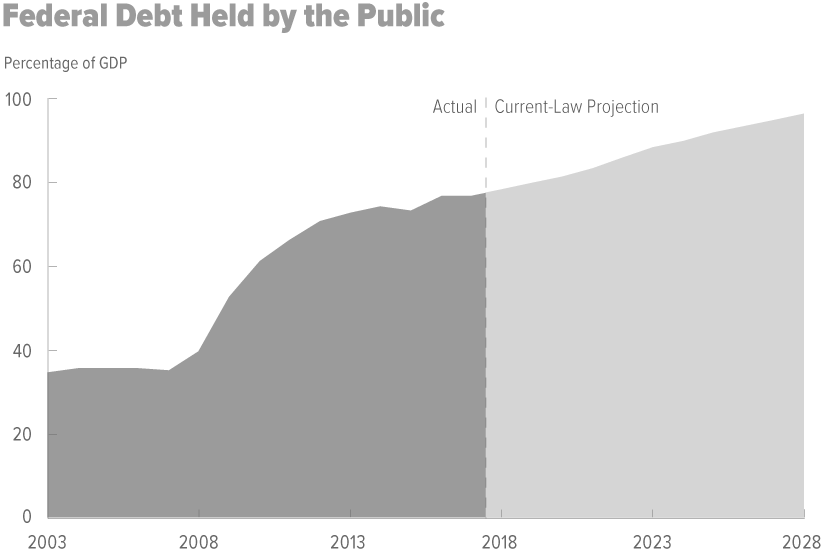

On Monday, the Congressional Budget Office released a report titled “The Budget and Economic Outlook: 2018 to 2028.” The report uses data from financial years 2003 to 2017 to predict the federal debt ten years into the future based on the current tax code, which was signed into law by President Trump in Dec. of last year.

The report predicts strong economic growth for the next two years, which will then become more moderate leading to a rapid increase in the federal budget deficit. The increase is then expected to become less steep around 2023, and will reach nearly 100 percent of the nation’s Gross Domestic Product by 2028. “That amount is far greater than the debt in any year since just after World War II,” says the report. “If lawmakers changed current law to maintain current policies – preventing significant increases in individual income taxes in 2026 and drops in funding for defense and non-defense discretionary programs in 2020, for example – the result would be even larger increases in debt.”

The report also projects that in the next two years the country’s production will exceed potential output leading to inflation and higher interest rates.

The CBO last released a similar report just over a year ago, and had to change some of their parameters in order to better reflect the country’s current economic and political status. “Projected output is greater because of recently enacted legislation, data that became available after the CBO’s previous economic projections were completed, and improvements in the agency’s analytical method,” says the report. “Also, because inflation is anticipated to be higher, the level of nominal GDP is projected to be 2.4 percent higher in 2027 than previously estimated.”

Members of the CBO had used the previous year’s projects to argue against President Trump’s tax overhaul last year.